Helen of Troy and Select Comfort

Introduction

This investment report addresses whether Select Comfort or Helen of Troy should be added as small positions, of up to 50 million between them, to the Aikens small/mid cap core portfolio. Both stocks are attractive, with more certainty behind Helen of Troy. Thus, the recommendation is to buy 30 million of Helen of Troy and 20 million of Select Comfort. Should, the next few data points continue to indicate a turnaround at Helen of Troy and that the 2nd half of 2006 was an outlier for Select Comfort, the positions should be increased as there would still be considerable upside.

Conclusions + Recommendations

Both Helen of Troy, a value stock which is cheap given potentially improving fundamentals, and Select Comfort, a growth stock that is discounting rapidly declining growth, sit at different kinds of crossroads. Helen of Troy, after 2 years of declining profitability and slowing revenue growth had a very strong 3rd quarter that suggests it may be turning around, sending the stock up 20%. Conversely, Select Comfort, after years of impressive revenue and earnings growth had a bad 3rd quarter. Further, preannounced that the 4th quarter is likely to be much lower than expected with negative sales comps and since October is down 30%. Despite these big moves resulting from dramatic data points, if Helen of Troy’s recent quarter is an indication of a turnaround, it is still cheap, whereas if Select comforts downside surprises are an indication of declining growth and pricing power, then it is still too expensive.

Both of these stocks appear to have attractive risk rewards, of roughly 30% downside to 100% upside in both, and it appears both the unattractive industry for Helen of Troy and the declining competitive advantage of Select Comfort are priced in. Both of these stocks appear worth buying, though there is more uncertainty in the forecast for Select Comfort as there are many more variables in play. Thus, the modeling and valuation behind this analysis is more suspect for Select Comfort. However, it seems if the model is incorrect with Select Comfort and things do get worse because of the high short position, it is likely the downside would be cushioned.

Select Comfort

Business Analysis

Select Comfort operates in the mattress industry, a 6 billion dollar industry, growing at roughly 6% annually (2% unit, 4% revenues). Four players, Sealy, Simmons, Serta and Spring Air, who sell primarily traditional spring mattresses, largely dominate the industry, accounting for 55% of sales. The retail industry is highly fragmented with Select Comfort being the largest player at just over 5% market share. There is a shifting trend to customers buying more expensive beds from specialty stores like Select Comfort. This trend bodes well for them. However, there are concerns for the mattress industry given macroeconomic and the weak housing market.

Select Comfort sells premium air mattresses, marketing them under the sleep number brand. Select Comfort recognized that other mattress companies didn’t use marketing budgets on building their brand, so they built their brand by heavily marketing the “sleep number” concept. Select Comfort, differs from competitors in that it is fully vertically integrated, producing, distributing and selling its mattresses, thus capturing both the manufacturing and selling margins. It owns 440 retail stores, which account for 78% of sales, and has one of the highest sales per square foot in the business at approximately 1333. They also signed an agreement to put mattresses in all Radisson Hotels, which also serves as a marketing initiative. Select Comfort also sells ancillary non-mattress items, accounting for roughly 20% of sales. Select Comfort also differs from competition in that they ship all mattresses from their two distribution centers (in

Porter Analysis of Mattress Industry and Select Comfort’s Position

Bargaining Power of Customers-The bargaining power of mattress buyers, for traditional mattress companies, is relatively weak. Mattress retailers are highly fragmented, without substitutes, more concerned about quality and lack the ability to backwardly integrate. However, the retailers are consolidating and in the process gaining more power. Select Comfort has already integrated forward with their own retail stores and has especially strong pricing power because of their differentiated product.

Bargaining Power of Suppliers- The bargaining power of the suppliers to mattress companies is also relatively weak. Their products are commodities and they are highly fragmented without the ability to forward integrate.

Threat of New Entrants- There is a risk of new entrants to Select Comfort’s dominant position in the specialty mattress segment. Competitor’s such as Sealy are looking to enter this segment of the mattress market because of its especially high margins. This fear is largely the reason for the high short interest. However, Select Comfort’s main differentiation is not their patents but their brand name and marketing, which does create some barriers to entry.

Threat of Substitutes- There is a threat of substitutes to Select Comfort’s air mattresses from Tempur Pedic’s visco-elastic mattresses (which themselves are facing increasing competition in their type of mattress).

Intensity of competitive rivalry-The mattress industry is becoming increasingly competitive. Sealy and perhaps some of the other big four traditional mattress manufacturers (Simmons has an insignificant current foray into the air mattress sector) could enter into Select Comforts segment of the industry, attracted by the very high gross margins.

Overall this is a decently attractive industry, where Select Comfort has a good competitive edge as a result of their vertical integration and brand differentiation, achieved largely through their strong marketing efforts. However, the attractiveness of this industry, particularly for Select Comfort is declining with the increasing competition, and is the key reason it is so heavily shorted.

Management

Select Comfort’s management is headed by William McLaughlin, who was formerly the president of Frito-Lay Europe. James Raabe is the CFO and has been with the company since 1992. This is a fairly experienced management team for a small company and they have so far done a good job leading the turnaround of Select Comfort since 2001. Management is expanding into a larger headquarters, which is never a good sign, but it seems like a modest and thus likely a necessary expansion.

Financials

Select Comfort has been consistently growing revenues at a rate of 25% since the Mclaughlin led turnaround started in 2001. Revenue growth has slowed slightly from 30% annualized in 2001 to 2003 to 23% annualized from 2003 to 2005. Operating income (as 2002 benefited from a tax loss carry) became positive in 2002, and after doubling in 2003, has grown 20% in 2004 and 33% in 2005. Operating margins, after increasing from 6% in 2002 to 9% in 2003, have remained constant. ROA has remained constant at 18% over the last 3 years, while ROE has increased from 29% in 2003 to 36% in 2005.

Likely as a result of their shipping from their distribution centers, Select Comfort’s days to sell is very low and decreased to 32 in 2005 from 42 in 2003. Days to collect is also extremely low at 5 in 2005, likely because they control their distribution channels. Days payable was 38 in 2005, having been constant since 2003. The efficiency of operations can be seen in the cash conversion cycle of 0 days in 2005, showing the benefits they realize from being vertically integrated.

On Nov 30, Select Comfort reported that 4th quarter revenues would be much lower, as same store sales declined 9% (though some of this was because of price increases in 2005). Earnings guidance was lowered to 80 to 87 cents, when street estimates had been 96 cents. This came on top of a weak 3rd quarter. Management continued to reiterate 15 to 20% revenue growth and 20 to 25% earnings growth. However, this indicates that Select Comfort is suffering from the increased competition (it is unlikely the whole decline is from the real estate market), and possibly also that their unique marketing campaign has tired.

Competitors

Many of Select Comforts competitors (Simmons, Serta, and Spring Air) are private, with only Sealy and Tempur-Pedic being public. Tempur -Pedic is a very similar company to Select Comfort, both being high margin specialty mattress manufacturers. Both are over 20% shorted. Select Comfort has better gross margins by 8% but with Select Comfort’s heavy reliance on marketing, Tempur-Pedic has 10% higher operating margins. They have also rather equal revenue and growth rates as well as total revenue. Despite the much lower margins and thus a lower ROE, Tempur-Pedic trades at a discount to Select Comfort, with a 13 forward PE and 1.06 PEG compared to a 15 forward PE and .91 PEG. This may be a result of concerns about the sustainability of Tempur-Pedic’s competitive advantage, and while this is the same concern that has Select Comfort heavily shorted, Select Comfort maintains a better brand moat due to advertising.

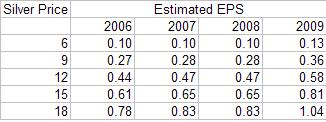

Valuation- FCFE using growth sensitivity

There is a lot of uncertainty surrounding Select Comfort’s valuation at the moment, largely dependent on whether the mid quarter update was a blip or signifying a slower rate of growth, and a shorter period of higher growth. Therefore two scenarios have been modeled for the different growth trajectories using a two stage FCFE growth model.

The first scenario assumes a 3 year period of higher growth at 15%, with revenue growth at 12%. This scenario is possible particularly if there quickly becomes more competition, slowing revenues and growth. At a stable growth level, a 6% growth rate was assumed with a ROE of 15%, which would imply a revenue growth rate equal to the industry average and stable margins. These assumptions gave Select Comfort a valuation of 14, or roughly 20% below the current market value.

The second scenario assumes a 4 year period of higher growth of 20% (still below the last few years) with 15% revenue growth, which is roughly what company guidance is. The stable growth rate is key here as if it Select Comfort can maintain a sustainable advantage keeping the growth rate at 8% (above industry growth), it would give Select Comfort a valuation of 40, which is considerable upside. With a growth rate of 6%, the valuation is 30, which is still roughly 80% above the current price.

However, there are no guarantees that either of these scenarios is realistic. It is entirely possible that the competitiveness of the specialty retail industry accelerates such that the long term growth rate is 2% for example, leaving the pessimistic scenario at a value of 13 and the optimistic scenario at a value of 22. It is also possible that both scenarios are too positive on the length of higher growth, which could be the case if competition is increasing and their message and penetration is slowing as the warning showed. If the both models only assume 2 years of growth and 4% sustainable growth, the values fall to 12 and 20 respectively.

Investment Conclusions

Select Comfort is clearly at an inflection point. It is heavily shorted, and as recently was proven, there was at least some validity for this. If it can maintain a reasonably high level of growth, by maintaining margins, growing revenues in the high teens, and keeping new entrants from penetrating its high share of the air mattress market, it will prove the shorts wrong and double or triple from current levels. However, should larger players like Sealy successfully enter and competitors in the specialty space impede on Select Comfort, the decline in margins and revenue growth will severely impact the short term and sustainable growth rate.

The market is more heavily discounting the negative scenario, particularly after the recent preannouncement. There is significant risk that Select Comfort will not perform well but the risk reward makes this a compelling situation. A lot can continue to go wrong here without the stock losing more than 20% of its value. Thus while the miss was very bad, it did not guarantee that high levels of top and bottom level growth were necessarily over. Therefore, Select Comfort is an attractive but risky stock.

Helen of

Business Analysis

Helen of Troy operates in the personal care and appliances industry; with a relatively unique business model (a few smaller companies such as Applica and Salton have similar models). Some of their competitors are Nu Skin, Playtex and Spectrum Brands. Helen of Troy markets and sells a wide range of products; many of them licensed brand names. Its own trademarks include, OXO, Brut, Vitalis, Final Net and Helen of Troy, while it licensed trademarks include Vidal Sasson, Revlon, Sunbeam and Dr. Scholl’s. They leverage their strong cash flow, established far east suppliers and broad distribution system to acquire new products and brands. One problem they have is that because they outsource all production to the far east, they have to anticipate inventory 90-120 days in advance.

Porter Analysis of Helen of

Bargaining Power of Customers- Helen of Troy customers are powerful as they have a wide range products to choose from, though products are differentiated which somewhat limits their leverage. Additionally, their top 5 customers including Wal-Mart and Target account for 45% of total sales, weakening their position. This is an area of large concern.

Bargaining Power of Suppliers- Helen of

Threat of New Entrants- There is a high threat of new entrants to most of their markets as they do not have any barriers to entry beyond the strength of their brands. Many small companies are introducing new products, sometimes marketing them through infomercials.

Threat of Substitutes- There are a lot of substitutes to most of Helen of Troy’s products (OXO being one of the few without many substitutes), as they are only differentiated by brand.

Intensity of competitive rivalry- The personal care and small appliances business is highly competitive, with relatively good margins and a number of competitors leaving it a very competitive industry.

Helen of Troy is in an unattractive industry that is highly competitive, without much bargaining power and not too many barriers to entry. The reliance on sales from Wal-mart and Target is an area of particular concern.

Management

Helen of Troy management is very entrenched, lead by Gerald Rubin, who founded the company in 1968 and owns approximately 20% of the stock (although the rest of management and directors own less than 1%). Alan Lee, the former president of Oxo, who has been there since 1994, still leads the division and has won many business design awards. However, management has made mistake after mistake, most recently over paying for Oxo and has had great difficulty integrating it into the company. Helen of Troy would likely be worth more and create more value with new management.

Financials

Helen of Troy’s revenue growth slowed to just 1.5% in 2005 after growing at 25% in both 2003 and 2004. Similarly earnings fell 35% in 2005 after growing from 2000 to 2004 at an annualized rate of 45%, as profit margins fell from 13.1% in 2004 to 8.4% in 2005. The dramatic decline in profit margins came from a 2% increase in COGS, a 3.5% increase in SG&A and a 1% increase in interest expense. Helen of Troy’s ROA has declined to 5.7 in 2005 from roughly 10% in previous years, where ROE declined to 10.7% from the high teens in previous years. Helen of Troy has also benefited from a decline in its tax rate from 24% in 2001 to just 12% in 2005.

This worrying trend continued through the first half of 2006, with a profit margin of 5% vs. 7.5% in 2005. In Q3, this trend was reversed and the profit margin of 7.4 was comparable with the previous year. Revenue growth was up 13% year over year, the first quarter of double digit revenue growth since Q2 2005, and earnings were up 15%, the first increase since Q1 2005. It’s unclear whether this was just an outlying quarter. The market perceived it very positively sending the stock price up 18% also on the backs of raised guidance.

One of Helen of Troy’s problems, likely a result of their outsourced manufacturing, is a poor days to sell, which eroded to 95 in 2005 from an already poor mid 70’s in both 2003 and 2004. Days to collect is also a poor 68, up from 50 in 2003. This is likely from their lack of power over their buyers. Days payable has also declined to 35 from 23 in 2003, although this is still acceptable, and still being ok for creditors is good for Helen of Troy. However, they have a cash to conversion cycle of 206, which underscores some of their inefficiencies seen in their poor ROA and asset turnover.

However, if the trend of no revenue growth and declining margins reverts to the growth of 2003 and 2004, Helen of Troy is still very cheap

Industry- Ratio Valuation

Helen of Troy competes with personal care and small appliance companies such as Alberto Culver, Nu Skin and Spectrum Brands. Compared to industry average Helen of Troy trades at a significant forward PE discount of 10.5 vs 15 and forward PEG discount at .80 vs 1.2. However, on an Ev/Sales of 1.4 and EV/EBITDA of 9, Helen of Troy trades in line with the industry average. This is largely a result of Helen of Troy’s very low tax structure.

Valuation- Constant FCFF Model

Helen of Troy should be valued using a simple constant growth DCF, assuming a trailing 12 month FCF of 47 million, a WACC of 11% (13.6% cost of equity, 5.7% cost of debt), and a growth rate of 5% (as this industry grows a little faster than GDP, particularly with the expanded baby boomer demographic). This gave Helen of Troy a valuation of 820 million that has a high sensitivity to the growth rate. With a growth rate of 8% Helen of Troy would be worth 1.6 billion, with a growth rate of 2% it would be worth 531 million. The growth rate here has tremendous implications. Attached is a table of growth rate sensitivity.

Investment Conclusions

Helen of Troy is in a mature, low growth industry that is highly competitive. It has been facing declining margins and slowing revenue growth and it incurred a lot of debt in buying OXO. It lacks any competitive advantage to achieve sustainable growth higher than the industry (it only grows through acquisitions) and is not run very efficiently with a high cash conversion cycle. Helen of Troy’s success is in a large degree tied to economic strength which appears to be at least solid. However, it is generating a high level of cash flow, and the risk reward considering the level of growth necessary to generate alpha seems to make Helen of Troy an attractive investment. It might be prudent to wait for more data to show that margins have stabilized and revenue is growing again, but considering the value in Helen of Troy, waiting could make the stock more expensive.

HELE Growth Rate Sensitivity

| Growth rate | Value |

| 9.00% | $2,530,126.43 |

| 8.00% | $1,678,127.48 |

| 7.00% | $1,249,503.08 |

| 6.00% | $991,482.25 |

| 5.00% | $819,114.33 |

| 4.00% | $695,820.52 |

| 3.00% | $603,254.91 |

| 2.00% | $531,202.91 |

| 1.00% | $473,525.66 |

| 0.00% | $426,311.59 |

| -1.00% | $386,950.30 |

| -2.00% | $353,633.07 |

![[Most Recent Charts from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)